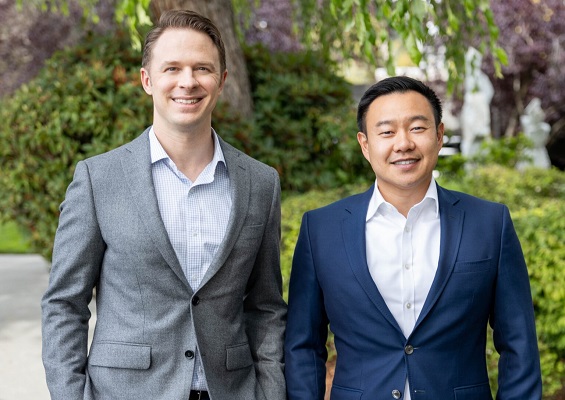

Two longtime tech and finance executives who graduated from the United States Military Academy, Eddie Kang ’08 and Rob Hammond ’09, are leading a new Seattle-based investment firm.

Gray Line Partners got off the ground earlier this year and is investing in software-as-a-service businesses across North America. It targets companies with $2-to-$10 million in annual recurring revenue, with “really strong fundamentals,” said Kang, managing partner at Gray Line.

Kang described Gray Line as an “early growth equity firm” that isn’t focused on startups that have raised gobs of cash and need to hit huge revenue growth metrics.

“We don’t do venture capital,” Kang told GeekWire. “We invest in companies that have proven product market fit and demonstrated that ability to have repeatable new customer acquisition and retain customers.”

“We’re looking for companies that are focused on being efficient,” he added.

Part of Gray Line’s belief is that many SaaS businesses don’t actually need a lot of investment to spur sales and grow profits.

“Our thesis is that there are a lot of founders that would rather take less capital,” Kang said.

That strategy may prove fruitful given the current state of the venture ecosystem, with ongoing liquidity constraints and a cash crunch for many startups.

AI is helping software businesses do more with less, Kang noted, which can supercharge efficiency and make companies less reliant on future investment.

Gray Line recently led a $11.5 million funding round for Actuate, a New York startup developing computer vision software used for remote security camera monitoring and threat detection. The company’s AI-fueled tech can allow a security guard to respond to alerts on hundreds of cameras.

“I don’t think you’re ever going to replace all the humans,” Kang said. “But I do believe that humans can be a lot more productive and a lot more efficient with AI.”

Gray Line, which typically leads investments, is also using AI to help identify potential investments. It built its own sourcing model that scours the internet for information and finds attractive companies based on the firm’s thesis and parameters.

“It allows us to be extremely scalable on the investing front,” Kang said. He added: “We eat our own dog food.”

Kang was a captain in the U.S. Army and served in Korea and Afghanistan. He later got into investment banking and worked for firms including Telescope Partners, Next47, and Seattle-based Tola Capital, which he described as “an incredible firm.”

Kang then spent two years focused on growth equity investments for Point72 Ventures, which has been more active in the Seattle area lately.

Rob Hammond, partner at Gray Line, worked with Kang at Point72 and previously spent time at Canoo and Rothschild & Co.

The name of the firm is a nod to the phrase “The Long Gray Line,” a reference to alumni from West Point.

“It’s the idea of being able to be helpful toward each other and being successful together,” Kang said.